arkansas estate tax return

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. If you make 70000 a year living in the region of Arkansas USA you will be taxed 12387.

Arkansas Retirement Taxes And Economic Factors To Consider

AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Cridits Etc.

. In the case of the estate of a resident or a nonresident who dies having real property andor tangible personal property. Individual Income Tax Name and Address Change Form. Tax returns and on the Arkansas.

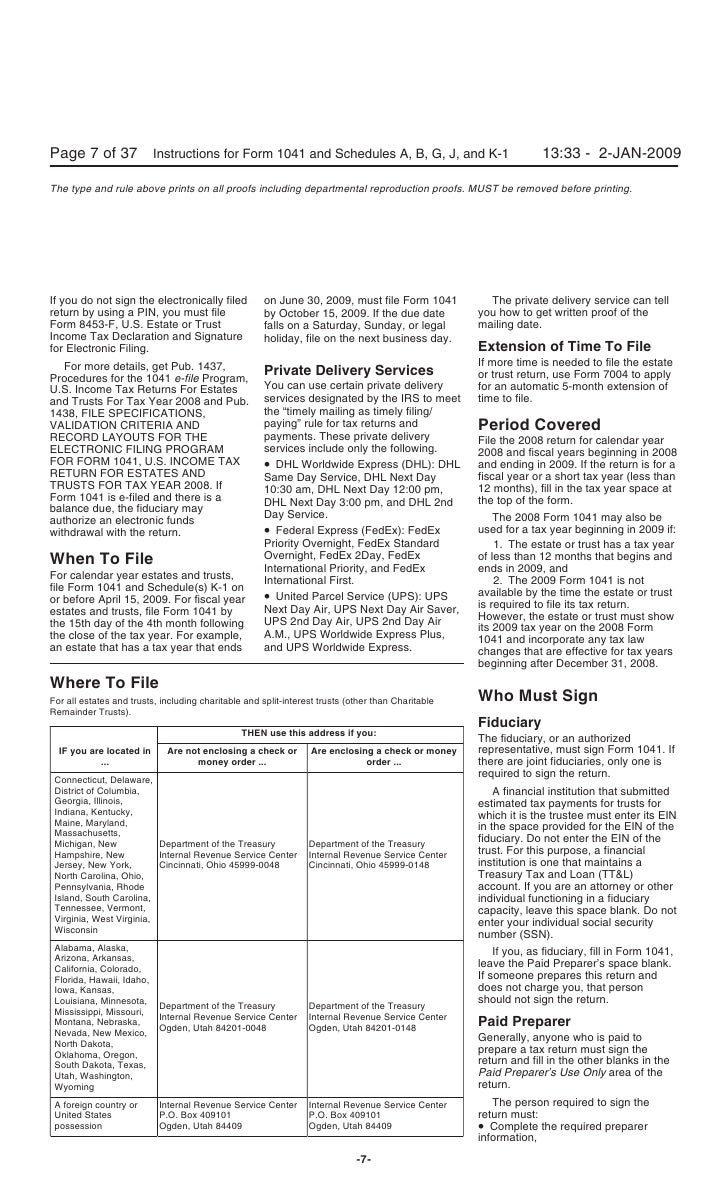

A return for the estate or trust for which heshe acts provided any of the following apply. Check your refund status at. One 1 copy of the approved request must be attached to the return when filed.

Check the status of your Arkansas Income Tax return. Little Rock AR 72203-3628 If you owe tax make your check or money order payable to Department of Finance and Administration. Any income of such estate or trust is currently distributable.

AR4506 Request for Copies of Arkansas Tax Returns 12292020. Arkansas Estate and Inheritance Tax Return Engagement Letter - 706 US Legal Forms offers access to the largest collection of fillable forms in Word and PDF format. One 1 copy of the approved request must be attached to.

Your average tax rate is 1198 and your marginal. On Arkansas income tax returns taxpayers must file following the rules in sections 167 168 179 and 179A under the Internal Revenue Code of 1986 enacted January 1 1999. Identity Theft has been a growing problem nationally and the Department is taking additional measures to ensure tax refunds are issued.

When the income was reported and taxable on the other states tax return and on the Arkansas Fiduciary Return. The types of taxes a deceased taxpayers. If you choose to electronically file your State of Arkansas tax return by using one of the online web providers you are required to complete the form AR8453-OL.

Attach a copy of the tax returns filed with the other states. AR-MS Tax Exemption Certificate for Military. Effective tax year 2011 the.

Go to Income Tax Refund Inquiry. AR1002F Fiduciary Income Tax Return. Arkansas Estate Tax Return.

One 1 copy of the approved request must be attached to. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan. Arkansas Income Tax Calculator 2021.

This tax is item 5b on the Arkansas Estate Tax Return Form. AR4FID Fiduciary Interest and Dividends. Be sure to write your Social Security Number and.

Department of the Treasury. 4810 for Form 709 gift tax only. Arkansas Estate Tax Return andor Pay Estate Tax AR321E File this request in triplicate on or before the due date of the return.

Get instant answers to hundreds of questions about.

Offer And Acceptance Form Arkansas Fill Out And Sign Printable Pdf Template Signnow

Guide To Resolving Arkansas Back Taxes Other Tax Problems

State Death Tax Hikes Loom Where Not To Die In 2021

Estate Tax Rates Forms For 2022 State By State Table

Massachusetts Resident Estate Tax Return Form M 706 Form M 706 Us Legal Forms

Estate Tax Rates Forms For 2022 State By State Table

Arkansas Real Property Tax Affidavit Of Compliance Form Fill Out Sign Online Dochub

Free Arkansas Marital Settlement Divorce Agreement Word Pdf Eforms

Fillable Online Ar321 Estate Tax Form And Instructions Arkansas Department Of Fax Email Print Pdffiller

Free Arkansas Tax Power Of Attorney Form Pdf Eforms

Arkansas Gift Tax How To Legally Avoid

Homestead Tax Credit Real Property Aacd

State By State Estate And Inheritance Tax Rates Everplans

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Arkansas Military And Veterans Benefits The Official Army Benefits Website

Creating Racially And Economically Equitable Tax Policy In The South Itep

Instructions For Form 1041 U S Income Tax Return For Estates And Tr